Tax laws changed this year—some changes are negative, while many changes can be used to your benefit and save you a huge chunk of your income. It just comes down to strategy.

And it’s more important than ever to have a tax strategist on your team to properly position you correctly. Don’t have an excellent CPA or tax strategy? Jump on a Gap Analysis Strategy Session call with our experts!

The Most Important Aspects to Know About the Changes in the Tax Code Today for Businesses Are These…

One, there was a new 20% tax deduction for non-professional entities; and two, associated entertainment deductions have been eliminated.

What does that mean to you? Simply put, if you are, for example, an attorney or real estate broker, the flat 21% business tax fee you would have to pay both as an individual and a business will no longer be off-set by previous deductions of the past. Additionally, all the business development via meals and even travel deductions are now restricted.

The new 20% tax deduction, unfortunately—if you are a specific profession (such as a lawyer or insurance broker, for instance)—will not apply to you. However, you do have a method for leveraging the new business tax changes to benefit you. It starts with a little creativity.

For Professional Entities: Create a “Non-Management” Company That Is SEPARATE From You and Your Professional Business

By doing that, you are in effect leveraging that new 20% tax deduction to off-set the massive 21% tax fee you will have to send to the IRS. In the past, that is quite the alarming difference as long as you take advantage of it. In practice, you will see a 20% tax difference, which will save you in theory as much as $80K if your business earns $100K in profit, for example.

That would stand to be a major advantage for service professionals out there provided the right steps are taken: shield yourself from the disadvantages by setting up a separate “business” to leverage the new deduction as you transfer your revenue into that business and let that become the “pass-through entity.”

For All Entities: Bear in Mind The New Restrictions in Associated Entertainment and Travel Tax Deductions

To be specific, in the past those deductions were at a full 100% write-off. It simply means that professionals clear and wide from industry to industry could nurture business with prospects, clients and colleagues via dinners, golf outings and more, then write all of that expense off on their taxes for a much larger return down the road. The new tax law changes have reduced that to 50%, so keep that in mind and recognize the trade-off is, in fact, worth it.

And Lastly: Work With an Excellent Tax Team Who Are Heavily Involved in Your Business Plan and Entity Structure

You can undoubtedly benefit from these tax law changes as long as you ensure you have an excellent tax team that knows how to utilize the changes to your advantage, and is documenting everything so that there is a paper trail. Develop your plan and work the numbers. Have a resolution as well as a monthly recheck to ensure you and your business are doing everything you’re supposed to be doing.

At the end of the day, the most important action is making sure you have the right team handling your taxes and your entity strategy—and only then can you be sure you’re taking full advantage of the new tax laws to save the most money possible.

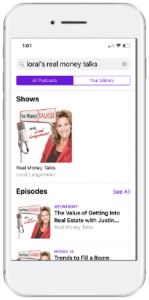

Listen to the Podcast on Your Phone

Do you wonder whether you’re using all the tax, entity and wealth strategies available to you and if your investments are truly producing all they could be? Get in on the only conversation about money you need to be having with Real Money Talks.

Step 1.

Search for “Loral’s Real Money Talks” in your preferred podcast app or platform

Step 2.

Hit the “Subscribe” button