Does the word “retirement” make you cringe?

Even the highest income-earners stress over the financial instability that comes with retirement. You may already contribute to a company-sponsored retirement account, but many of these plans don’t work out the way they’re supposed to.

Financial companies put limitations on the investments that they hold, leaving you to play by their rules. Even worse, a majority of companies limit their 401K plans to just five mutual fund options. Thankfully, self-directed IRAs have revolutionized retirement planning. These savings and investment vehicles help put you on the path to multi-million-dollar wealth and to controlling your financial destiny.

Whether you need income or tax savings, these accounts let you take the reigns of your investments for retirement.The possibilities are endless with self-directed IRAs; which is why you’ll want to schedule a guided Gap Analysis, a free strategy session with one of our wealth-building and investment experts. This call will help you get a clear direction and roadmap, tailored specifically to your financial situation and your goals.

Then, you’ll need to implement your IRA strategy–which is critical to financial success.

Let’s look at the top three reasons why a self-directed IRA will help you save millions for retirement.

1. You Can Invest in Almost Anything

There’s a significant amount of misinformation when it comes to IRAs. Go to any bank or brokerage, and they’ll tell you that they only offer self-directed IRAs. But when you take a closer look, these IRAs are far from self-directed. They often limit their investment opportunities to stocks, bonds, mutual funds or CDs.

By seeking out a firm that specializes in self-directed IRAs, you can invest in anything that the government allows. The lack of restrictions untaps limitless potential to building multi-million-dollar wealth. For IRAs, the government only prohibits purchases of life insurance, collectibles, alcohol and self-dealing transactions. All other investment opportunities are fair game.

2. Roth Retirement Accounts Are Untaxed

Any savvy investor will tell you that a Roth retirement account is a wise investment. Why? They’re the only vehicle that allow you to go from “forever tax” to “never tax.” All the income generated from these accounts is entirely tax-free. This is extremely advantageous for someone looking to build a passive income stream, as your contributions and investment earnings will never be touched by the government.

But keep in mind; you can make actually “too much” to open a Roth IRA. Millionaires and high income earners are often turned down by financial institutions because of their income status. But, anyone with a self-directed IRA can open a Roth retirement account. You just have to know how to carefully maneuver this account to stay in accordance with the laws.

3. It’s Not Complicated

The greatest thing about wealth building through a self-directed IRA is it’s not complicated.

For example, a 50-year-old who makes an initial contribution of $4,000 can easily build tax-free, monthly distributions of $40,000 in 15 years. They can build a real estate portfolio inside the IRA and use an accelerated leverage strategy to fast-track mortgage payoffs.

And people who start young fare even better. A 21-year-old contributing just $5,500 per year with an average return of 10% can build over $3 million in wealth by the time they are 62. The account’s tax-exempt status also allows them to spend an income from the account of about $300,000 per year. Depending on your motivation, you can use your self-directed IRA to retire in less than 10 years. If you’re a younger investor, you can accomplish tremendous financial gain over the course of your life.

Self-directed accounts are just one piece of the wealth-building puzzle; but they are a critical piece. Self-directed IRAs provide endless opportunities to build millions through even the most modest of investment strategies.

Your next step is to evaluate what is best suited for you and your retirement goals–make sure you consult with the right experts to help you optimize your wealth and put you on the path to financial freedom.

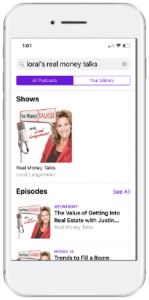

Listen to the Podcast on Your Phone

Do you wonder whether you’re using all the tax, entity and wealth strategies available to you and if your investments are truly producing all they could be? Get in on the only conversation about money you need to be having with Real Money Talks.

Step 1.

Search for “Loral’s Real Money Talks” in your preferred podcast app or platform

Step 2.

Hit the “Subscribe” button