If you’re a business owner, you should be filing your taxes in October. Which means, tax time isn’t over yet, like it is for the rest of the US—and you still have time to make sure you’re utilizing the best tax strategy you possibly can.

And that might mean firing your current accountant and hiring a new one after reading this article.

The number one mistake business owners make with accounting is blindly trusting their accountant to take care of everything without making sure they’re utilizing the best strategy possible for you. And the first mistake is hiring an accountant that isn’t the right fit. Which most often results in overpaying taxes and losing a large chunk of your hard-earned profits.

The US tax code has more than 80,000 pages—are you sure your CPA is well-versed in the entire tax code and the best strategies available to your business? A great tax accountant looks at tax returns like a puzzle—putting it all together not only requires extensive knowledge and experience, but the ability to look at the big picture and piece together a ninja strategy. Every piece counts, and any misplaced pieces can mean painfully overpaying…or worse, like trouble with the IRS.

As a smart and successful business owner it is important for you to fully understand your tax and entity strategy and make sure it’s the best strategy for you.

The first step is understanding the mistakes you’re currently making. A free, guided Gap Analysis strategy session with our expert team will help diagnose your biggest problems and lay out what you need to do to get your business where you want it to be. This is the first step to crafting a tax strategy that aligns with your business goals and saves you the most money possible.

We rely entirely on our accountant to handle our taxes and get us the most savings possible (unless you’re an accountant yourself), so it’s crucial you hire the right person for this high-stake task. And it’s critical that you understand the breakdown of your strategy and how you can maximize your tax benefits.

Ask your accountant these 8 questions to get a better understanding of your current tax strategy—and if they don’t provide good answers, then it may be time to get a new one.

1. What’s the difference between tax compliance and tax strategy?

Tax compliance is what most CPAs out there do. It is simply taking out your information, putting it on forms and giving you back the forms. It is reactionary, and there’s nothing you can do about the information.

Tax strategy, on the other hand, happens now for the current year and the future. It is reactionary and proactive at the same time. It allows you to plan ahead and be ready for what might happen one month or one year from now. You still have to do tax compliance because it is your responsibility, but having a smart and well-planned tax strategy is critical for your company.

2. What are the benefits of getting incorporated?

Most entrepreneur-led businesses sit too long under a sole proprietorship because they say they’re not ready to move up. Becoming a company means having annual corporate meetings and handling some administrative stuff, and some businesses don’t want these extra hassles. What they don’t understand however is that this work is very minimal and incredibly worth it for the benefits that they will get out of it.

There are so many strategies and benefits that you are missing out on if you are not using a corporate or entity structure, one of the biggest being the tax write-offs, and being much less likely to get audited.

3. When is the best time to set up an entity?

If you are earning income in your business, you should set up an entity. So in other words, right away. If you wait for a long time, you will have to redo all of your contracts because the day you start your company is technically the first day you are in business.

And it’s the same when you’re applying for a loan or credit. When banks ask, “How long have you been in business?”, it means how long have you been working as a company. So even if you’ve been under a sole proprietorship for more than 10 years, that doesn’t count. The sooner you become a company, the better.

4. Should you file for an extension or not?

Yes, you should file for an extension. Tax time is the busiest time of the year, and you’re not going to get the best out of your accountant at this time because they’re tired. Wait until after May to file your taxes, because your accountant will be brighter and on the ball by then.

Another benefit of getting an extension is that you can extend your entity return and wait until your extension date to fund your retirement plan. This is useful especially if you’re in a little bit of a cash crunch

5. What is one of the biggest myths about tax deductions?

One of the biggest deduction myths is that writing off your home office is a red flag for the IRS. It’s NOT. If your expenses are ordinary and necessary and directly related to the production of that income, then you can take that deduction. As long as you’re documenting what you are doing, getting audited isn’t that of a big deal. However, you need to remember that there are limits to what deductions you can claim. Same goes for all deduction categories. For example, with the current tax laws, you can’t write off any entertainment expenses after the meal.

6. What is one of the biggest bookkeeping mistakes people make?

Not doing your bookkeeping for last year until right before you file your taxes is one of the worst mistakes you can make. If you wait until today, it will be a lot harder to remember the details of last year’s transactions. You need to do your accounting right away.

7. What are the effects of the new tax laws?

If you have a W-2, you cannot deduct your employee expenses. You can no longer deduct miles, entertainment, travel, computer, phone and other employee expenses. Another big change is the limitation of income and property taxes. We used to enjoy an unlimited amount of property tax deductions, but now it’s limited to $10,000. New mortgage write-offs are also limited to $750,000. Another new feature of the tax reform is the 20% tax deduction out of the flow-through of business income, and the limiting of entertainment expenses.

8. What is the ideal tax strategy for a brand new entity?

If you’re just setting up your entity, the first thing you need to do is get your ID numbers, bank account and credit card for the sole use of your company. Then, get your bookkeeping organized monthly. Once these are set up, you will have an idea of your monthly profit and loss. This will help you in creating and planning your tax strategy.

Make sure you sit down with your accountant or have phone call discussions on a regular basis, so you can ask any questions that come up and constantly be involved in your tax and entity strategy.

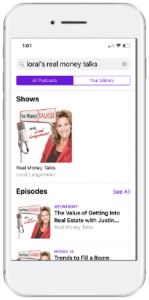

Listen to the Podcast on Your Phone

Do you wonder whether you’re using all the tax, entity and wealth strategies available to you and if your investments are truly producing all they could be? Get in on the only conversation about money you need to be having with Real Money Talks.

Step 1.

Search for “Loral’s Real Money Talks” in your preferred podcast app or platform

Step 2.

Hit the “Subscribe” button