Here’s the big misconception…

While single-family homes are the most popular and lucrative avenues of real estate investing, that’s not the only path you should be following. If you want additional cash flow revenue channels, you should break into apartment complexes.

Think About the Massive Cash Flow From Owning an Apartment Complex…

Consistent ROI, even when your apartment complex is not fully occupied. There is a system behind it, though, and you have to know the system if you’re going to invest in apartment complexes. Before you dive in, schedule a free, guided Gap Analysis strategy session with one of our wealth and investing experts to discuss your strategy, diagnose your current situation, and get you on the path to learning the system successfully.

Learning the system to building seven-figure wealth through real estate investing is critical; but to jumpstart you on learning the formula to small apartment investing, we’re going to go over 5 secrets to generating massive cash flow in the apartment complex market:

1. Start Off Small… Then Scale Up

Apartment complexes take work, but the increased cash flow from multiple rent payments add up. Because it’s a massive undertaking, you start small. You will learn the business by heading up property management to maintenance and repair, so start with a small apartment building—think ten houses or a 10-unit complex, and then scale up from there.

2. Know Where to Look for Your Prospects

There are three methods you want to focus on:

- Websites

- Brokers

- And Direct Mail

Websites are easiest, of course. But brokers can get you access to some of those pocket listings that’ll net you real quick earnings from the rent payments you hope for. The secret weapon, however, is direct mail. Why? You’re directly negotiating with current complex owners who already have tenants paying their rent. Negotiate with seller financing, cut out the competition, and reap the readymade cash flow.

3. The Key to Success Is Your Own Down Payment and No Personal Guarantee

You have to cover your own bases, basically. When working with seller financing, you want to protect your interests. Negotiate your own down payment and interest rate on the seller’s carryback.

Part of the bonus of seller financing is that you can avoid a credit check with everything negotiable. So you have a lot of freedom to move forward with this type of business. This is especially the case if you do default. Sure, the seller will take the property back, but with the proper contracts in place no one can seize your remaining assets. Again, protecting your interests…

4. Flip, Flip, Flip, and HOLD

What this means is, buy a complex and flip it for more capital to work with. Keep flipping and cherry pick the complexes you want to keep that earn more ROI. You can even leverage private investors and self-directed IRAs for even better cash flow without heavy spending. Simply negotiate the terms, defer interest, and watch your cash flow increase.

5. Stick with the Middle Ground

Corporations own the larger properties. If you’re going to scale, stick with midsize, as those are often the mom-and-pop investors who are willing to work with you. The good news is there will happen to be more zeros on your check even when everything’s the same.

The Best News Is You Don’t Even Need Any Qualifications to Do This

And once you know the formula, it’s simple—it’s all about the math. Don’t make the mistake of passing up this massive opportunity or delaying by thinking you need to be a real estate expert or guru. It’s the ultimate example of arbitrage… You’re simply spending a dollar to make two—and soon enough, multi-millions.

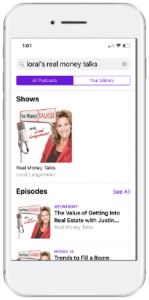

Listen to the Podcast on Your Phone

Do you wonder whether you’re using all the tax, entity and wealth strategies available to you and if your investments are truly producing all they could be? Get in on the only conversation about money you need to be having with Real Money Talks.

Step 1.

Search for “Loral’s Real Money Talks” in your preferred podcast app or platform

Step 2.

Hit the “Subscribe” button