Companies Make Money. Individuals Are Taxed.

There are 73,000 pages of tax codes in America available specifically for corporations.

If you’re like most business owners or aspiring entrepreneurs out there, you probably haven’t read any of them.

But here’s why they’re important – they help you keep more of what you earn.

Let me ask you this: Did you overpay in taxes this year?

Most of you did … and you don’t even know it.

Look, if you haven’t already, you need to set your life with a proper company structure.

That’s one of the key attributes of the wealthy – being legally set up the right way helps us keep more of what we make and really maximize savings.

Who doesn’t like keeping more cash in their pocket? 😉

Two of the best reasons for incorporating your business are taxation and protection.

When you set up a legal, corporate entity for your business, you will:

- Maximize your tax savings

- Protect your income streams and personal assets

- Protect you from being held personally liable for legal obligations

- Ensure you have money for business growth

Now, let’s review the most common legal, taxable entities you can use to keep more of your hard-earned money...

Limited Liability Company (LLC)

A limited liability company (LLC) can hold a business or assets, depending on your state. It is not a separate taxable entity. As an LLC owner, you will report business gains or losses on your personal income tax returns. In every state except Massachusetts, you only need one member to form an LLC.

LLCs are great for holding real estate or other assets, particularly for those who wish to limit their personal liability in such investments.

C-Corporation

A C-Corporation is a general, for-profit organization that pays taxes on the income it generates. A C-Corporation is a completely separate legal entity from the shareholders who own it, which means that shareholders cannot be held personally responsible for the corporation’s debts.

Forming a C-Corporation is, for most business owners, the first step in protecting your personal assets and reducing your tax burden. C-Corporations are allowed approximately 300 tax-deductible expenses! Compare that with an LLC, which allows about 150. You can also pay taxes quarterly, which allows you spread out your tax implications over the year.

S-Corporation

An S-Corporation is different from a C-Corporation because it is considered a “pass through” tax entity. This means that the taxable income earned by the S-Corporation is passed through to the shareholders; thus, the corporation itself does not pay taxes, the shareholders do.

To create an S-Corporation you must first form a C-Corporation and then elect to switch it to “S” status with IRS Form 2553. This decision means that you are deciding to have your corporation’s earnings treated like a sole-proprietor or partnership income. As a shareholder of an S-Corporation, you still benefit from personal protection from liability claims against the corporation.

And that’s it!

Of course, everybody’s situation is different, so get in contact with my team to make sure you’re making the best decision for you and your business.

To learn more about choosing the right entity for you, and the trusts and other assets available, listen to my Real Money Talks podcast episode, “What Corporate Entities are the Right Fit for You and How to Use Them.” Be sure to subscribe, rate and review!

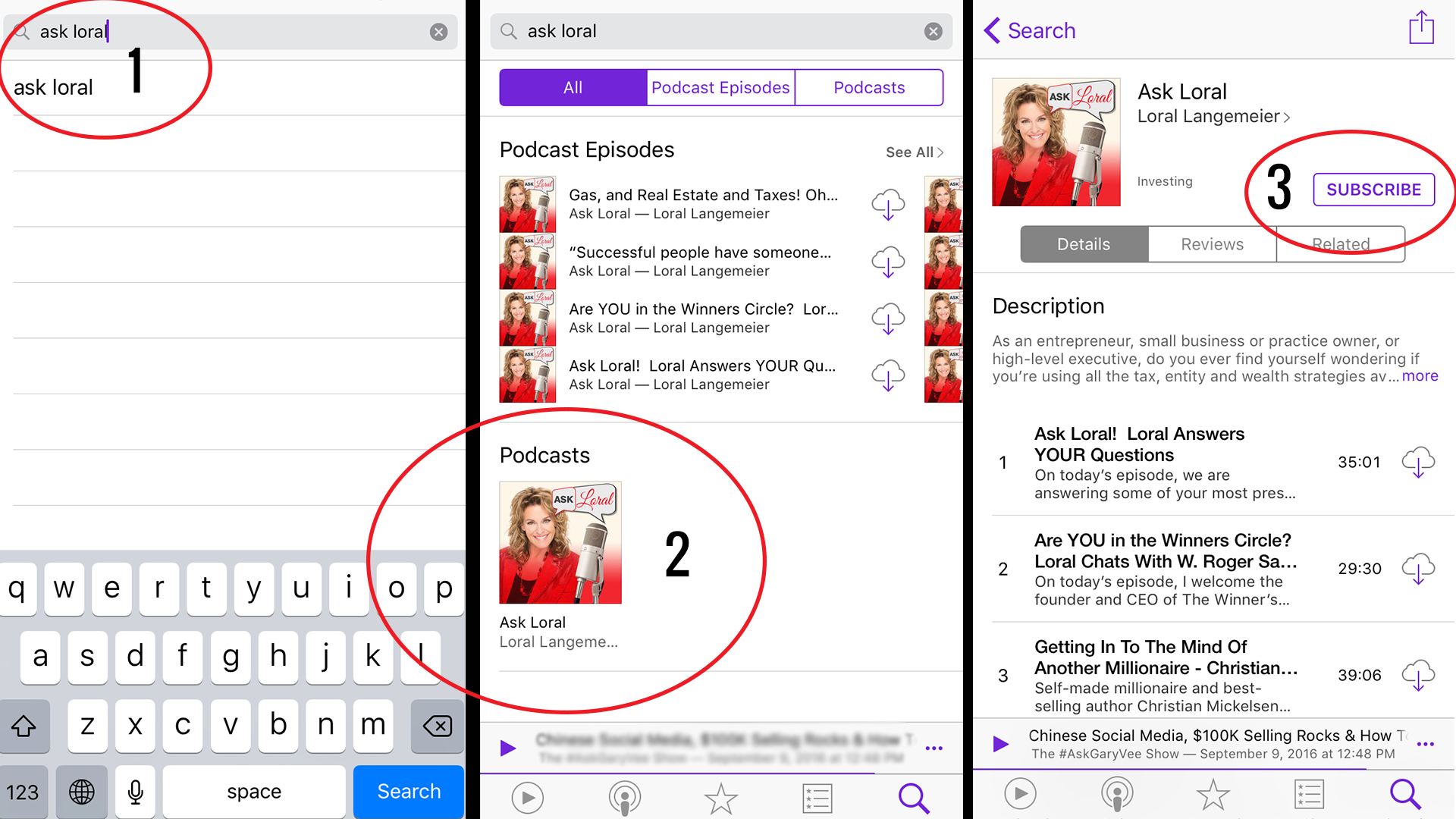

Step 1: Search for 'Ask Loral' in your podcast store

Step 2: Click on my face 😉

Step 3: Hit the shiny 'Subscribe' button

Share This If It Resonates With You Or If You Agree!

Let Us Know What You Think!

'LIKE' US ON FACEBOOK

TWEET US

OUR WORLD IN PHOTOS

LET'S LINK UP

CONNECT ON GOOGLE+

#ASKLORAL

Want free business coaching from one of the world's leading wealth and entrepreneurial minds? Join us at our upcoming #AskLoral LIVE webinar!

Copyright 2016 - Live Out Loud & Loral Langemeier - All Rights Reserved

ABOUT | WEALTH TRAINING | SUCCESS STORIES | COMMUNITY | BLOG