Leverage Your Good Debt and Grow Your Business

You’ve heard me say it before and I’ll say it again: There are two money conversations in the world - the occupational and the entrepreneurial.

The occupational conversation is about getting a job, getting an MBA, maximizing your 401K, and hoping that everything works out for the best.

That’s not the conversation we’re having.

We’re having the entrepreneurial conversation. That’s the one that will allow you to grow, to make money as a corporation (the best kind to make), and to leverage your money ... including your debt.

So let me first explain that not all debt is bad. Just like money has quality - the worst being what you make from payroll because of the tax burden - so does debt.

Good debt is leveraged against assets.

Here’s an example. I own a plane and it cost $3 million. To buy it, I put down a third, $1 million, and financed the other $2 million at a low rate, about 3 percent. Today I still owe about $900,000. Instead of paying it off, I (somewhat) happily continue to make payments.

Why? Because I take that money and buy energy stocks or property. One of my favorite investment strategies right now is acting as “the bank,” financing other people’s ventures and making 10-12 percent on my money ... plus points. 😉

Instead of using $900,000 to pay off debt, I maximize my money. That’s what makes the financing of my plane good debt. I’m leveraging the cost of money: the 3 percent of the plane versus the 12 percent of my “bank.”

If you have a weird feeling about the concept of debt, you probably weren’t trained properly.

Now if you have bad debt, like credit cards with high interest rates, OF COURSE pay them off. But I challenge you to look at all of your debts and really break them down. Take some time to look through your credit card statements and decide whether each item is a business or personal expense.

Can’t write-off those shoes you got? Put that in the “bad debt” column. The computer you use for your business? That’s “good debt.”

It’s okay to have debt, I promise. Every millionaire has lots of debt ... leveraged properly.

If you want to learn more about how to leverage your good debt, listen to my Real Money Talks podcast, "Good Debt vs Bad Debt." Be sure to subscribe, rate and review!

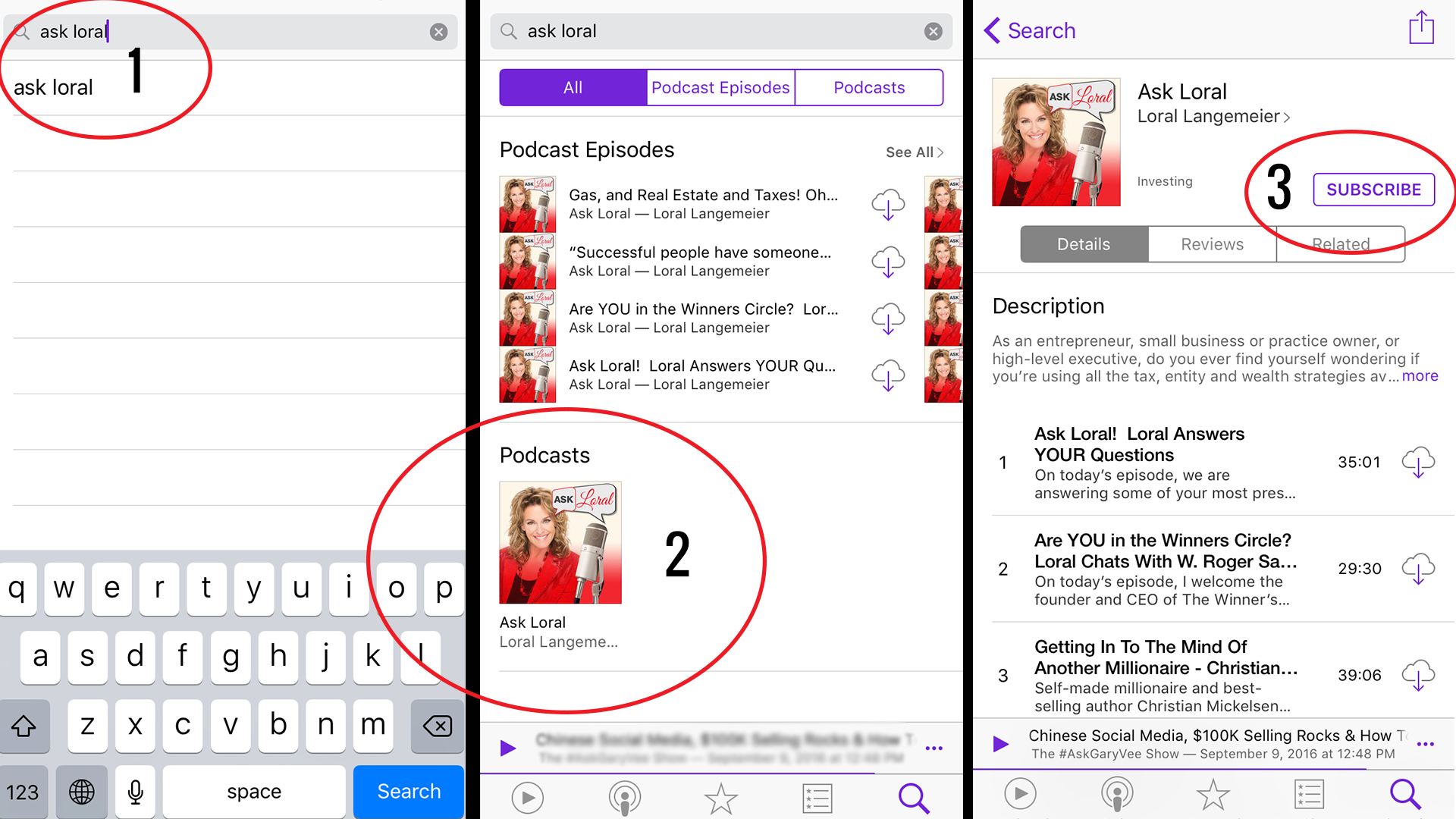

Step 1: Search for 'Ask Loral' in your podcast store

Step 2: Click on my face 😉

Step 3: Hit the shiny 'Subscribe' button

Tell Me How You Leverage Your Good Debt and Dump Your Bad Debt!

Let Us Know What You Think!

'LIKE' US ON FACEBOOK

TWEET US

OUR WORLD IN PHOTOS

LET'S LINK UP

CONNECT ON GOOGLE+

#ASKLORAL

Want free business coaching from one of the world's leading wealth and entrepreneurial minds? Join us at our upcoming #AskLoral LIVE webinar!

Copyright 2016 - Live Out Loud & Loral Langemeier - All Rights Reserved

ABOUT | WEALTH TRAINING | SUCCESS STORIES | COMMUNITY | BLOG