There are many ways a real estate investment can go wrong…

But if you have the right strategy, investing in real estate can make you millions in revenue.

So how do you ensure that a property is going to be a good investment?

Here are four critical steps you should follow when investing in real estate…

1. Buy for Cash Flow

Analyze the potential cash flow of the property before capital growth expectations. How much is it going to cost, how much is it going to pay, and is it an emotional decision or a decision based on the working numbers?

How much is it going to grow by? is it going to offset that loss in money?

If it is going to make money then look at how much this property is paying, and ask if the property is crucial in achieving the financial goals desired for this particular property.

2. Look for Real Validation and Proof

Mortgage professionals promote themselves with yard signs, online ads, billboards, above the subway train’s door, and even sponsored public benches. Cutting through all of the advertising hype can be tough. Still, there are ways to size up a professional’s record—and potential.

- Ask them to provide a list of what they’ve listed and sold in the past year, with contact information.

- Ask what their closing rate is.

- Look at how closely their listings mirror the prospective property. Are they in the same area? Is the price range similar?

- Research the area beforehand. If the professional knows the property and area, then they will know important information like population growth or decline and whether the economy is growing or not. And if they’re right, then they truly do know the area.

- Sometimes you can get seller financing at 6 or 7%. This is better than hard money lending at 14%. Look for a local investment group to find these lenders.

- Self-directed IRAs are a smart, savvy way to invest. Just be sure to check fees before getting locked into a company.

3. Get Pre-Approved

Before looking at if a property is a good investment or not, or looking at ways it can maximize income or value of the property, it’s important to get pre-approved so that ROI numbers can really run permitted amounts.

Get pre-approved up front to know what the numbers are and to make sure you have a realistic amount of cash flow before looking at properties.

Not sure what strategy you should be taking and what numbers you should be looking at based on your current financial situation? Request a free Gap Analysis Strategy Session with our investing and wealth building experts right now and discover what your biggest gaps and obstacles are and the roadmap you should be following.

4. Know State Laws and Taxes

The lower the price of a property the lower the risk is, so look for cheaper properties with the same cash flow as their competitions.

But none of this matters without awareness of state laws and taxes. In order to maximize capital gains, know the state laws and taxes! And look for returns of no less than 8%, but really, try to shoot for 14% and up.

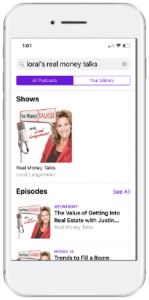

Listen to the Podcast on Your Phone

Do you wonder whether you’re using all the tax, entity and wealth strategies available to you and if your investments are truly producing all they could be? Get in on the only conversation about money you need to be having with Real Money Talks.

Step 1.

Search for “Loral’s Real Money Talks” in your preferred podcast app or platform

Step 2.

Hit the “Subscribe” button